Hey there, Welcome to

Global Fin X

Embrace quality with confidence

Global Fin X is Initiated with the objective of offering the New Age aspirants a highly esteemed and globally demanding career breakthroughs in various Accounts & Finance professional qualifications.

We strongly believe in quality education, value addition and are inclined to make learning passionate and fun.

- "Education is a process of excitement not an exercise"

Our Wings - Services we offer

Academic Wing

Learn International Finance and Accounts qualifications from the best with real life examples. experiences and a fun filled knowledgeable classes using the updated and convenient technological resources.

Advisory Wing

Offering one stop solution to all your Accounts, Finance, Audit, Taxation and other compliance requirements. we are a bunch of young, energetic, qualified and enthusiastic panel of consultants.

Skills Wing

Gain practical knowledge on industry required tools and sharpen your skillset to be Job ready. Offering ISO Recognized certification courses like Robotic Process Automation (RPA). Tally ERP.9, Quickbooks, & MS.Excel

ACCA Portal

One stop solution for all your ACCA needs. PER, Ethics Module related information, enrolling to tuitions, Accessing class notes, Quizzes for CBE Practice, etc in one place.

International Accounting, Finance And Management

ACCA (UK)

Association of Chartered Certified Accountants (ACCA) is the professional body’s main qualification.

CMA (US)

Globally recognized professional credential by the Institute of Management Accountants (IMA – US) .

Diploma in IFRS

This certification gives you the global credibility as IFRS expert.

Recorded Classes on your PC, MAC, Tab, I-Pad, I-Phone or Android.

On successful enrollment for the classes with Global Fin X, the students shall be provided with credentials. Students can access the classes through both Windows PC/Laptop/Mac and their Android Mobile/Tablets/I-Phones/I-Pads.

By default the students will be given access till the exam window for which they enroll. In case of issues where student is unable to appear for the exam or couldn’t clear the exam, the validity will be extended on request.

Any particular lecture can be opened unlimited number of times by the student, but the total watch duration will be restricted to 3x of the duration of the lecture.

Eg : If a lecture is for a duration of 60 Minutes, the student will have a view access for 180 (60*3) minutes. If the student opens the lecture and plays it for 20 Mins and closes the lecture, they will still have 160 minutes of View time left. They can again start from the beginning or resume from where they left.

All relevant materials will be shared through respective Telegram groups and Google Drive.

A PDF copy of the Digital class notes including the hand written notes by Faculty, any excel solutions worked out in the lectures etc will also be available to the students through the Google Drive.

Students can contact Faculties for all their doubts over Telegram.

Telegram ID : Global_Fin_X

Manikanta Sir ID : SaiManikantaP

In Case the student doesn’t use telegram they can contact via WhatsApp on +91-8328080730

ACCA Skills Level Demo Lectures

Financial Reporting - F7/FR

Financial Reporting is a subject that needs good understanding of IFRS & IAS, Watch Manikanta Sir simplify the standards and make it a cake walk for the students.

Audit and Assurance - F8

Watch Manikanta sir decode Audit Risk effectively with ease. With practical real life examples and in-depth knowledge of the subject audit is not a difficult paper anymore.

Financial Management - F9

Watch how Options (derivatives instruments) work in real life with practical trading examples. Including Charts, Graphs and Open interest in Market.

ACCA Professional Level Demo Lectures

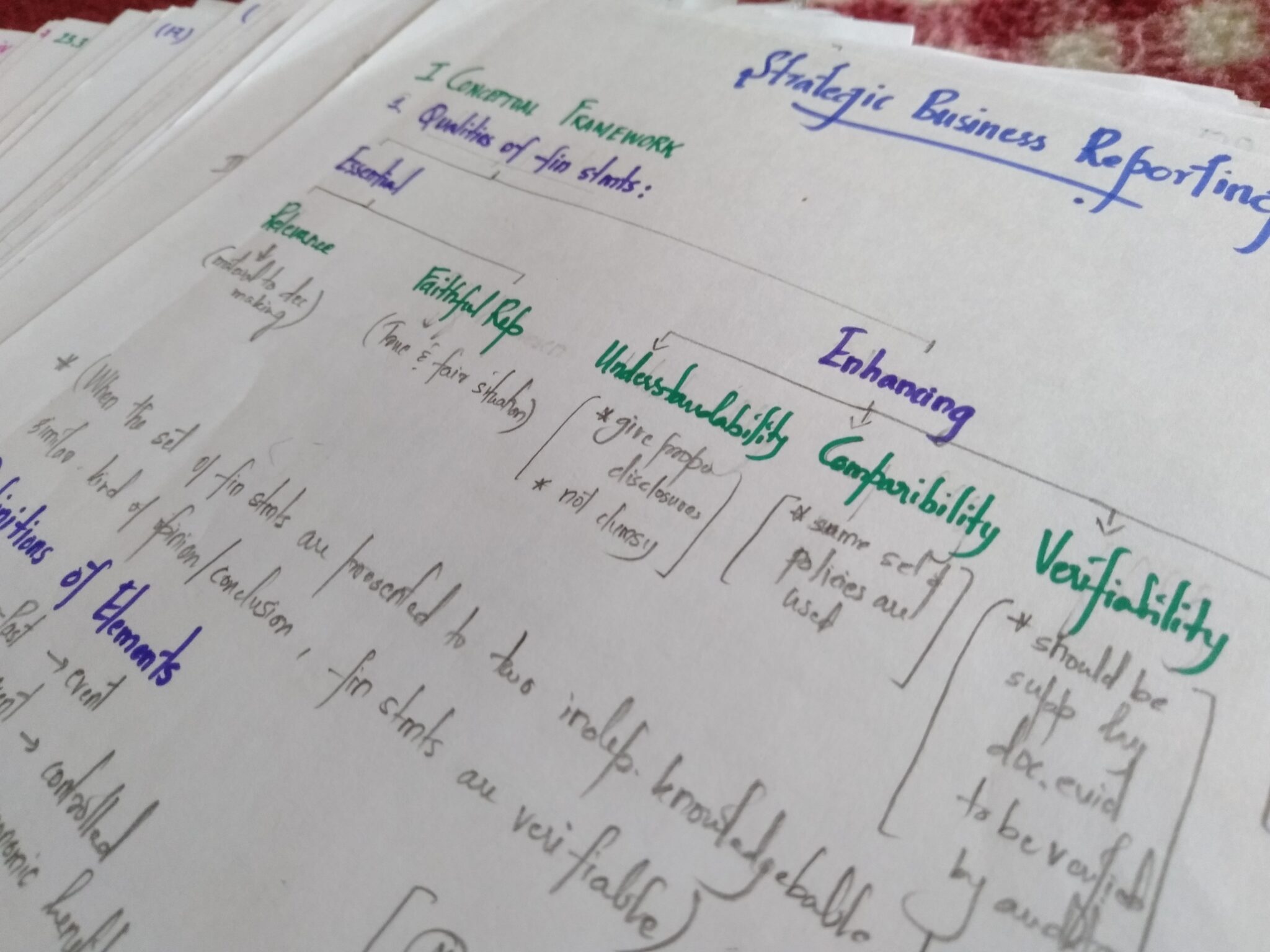

Strategic Business Reporting - SBR

SBR is a paper that needs comprehensive knowledge of IFRS. Credit Loss Model in IFRS 9 is considered one of the most difficult topics in SBR. Is it really difficult ?

Advanced Performance Management - APM

APM is a paper many students don’t opt for out of fear of Failure. Watch this video where Manikanta Sir decodes and demystifies the paper.

Advanced Financial Management - AFM

“Money market hedging is confusing, its lengthy, you always make mistakes in calculations”. These are casual statements passed. Watch the video to prove them wrong.

Testimonials

What our students say.

Place your cursor on the testimonial to stop auto scrolling.

The ‘Application’ of learned bookish knowledge was the main focus! Manikanta sir always invited student participation and encouraged the quieter students to take an initiative in discussions.

Though Sir always say, "Motivation doesn't really work", ironically, he is the source of inspiration and motivation to lot of students. “Thank you” won’t be enough sir.